indiana estate tax return

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The estate would pay 50000 5 in estate taxes.

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Fill-in pdf IT-41 Schedule IN K-1.

. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. For more information please join us for an upcoming FREE seminar.

Up to 25 cash back A federal estate tax return will be required only if the deceased persons taxable estate is very largefor deaths in 2022 more than 1206 million. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. The deceased was under the age of 65 and had adjusted gross income more than 1000.

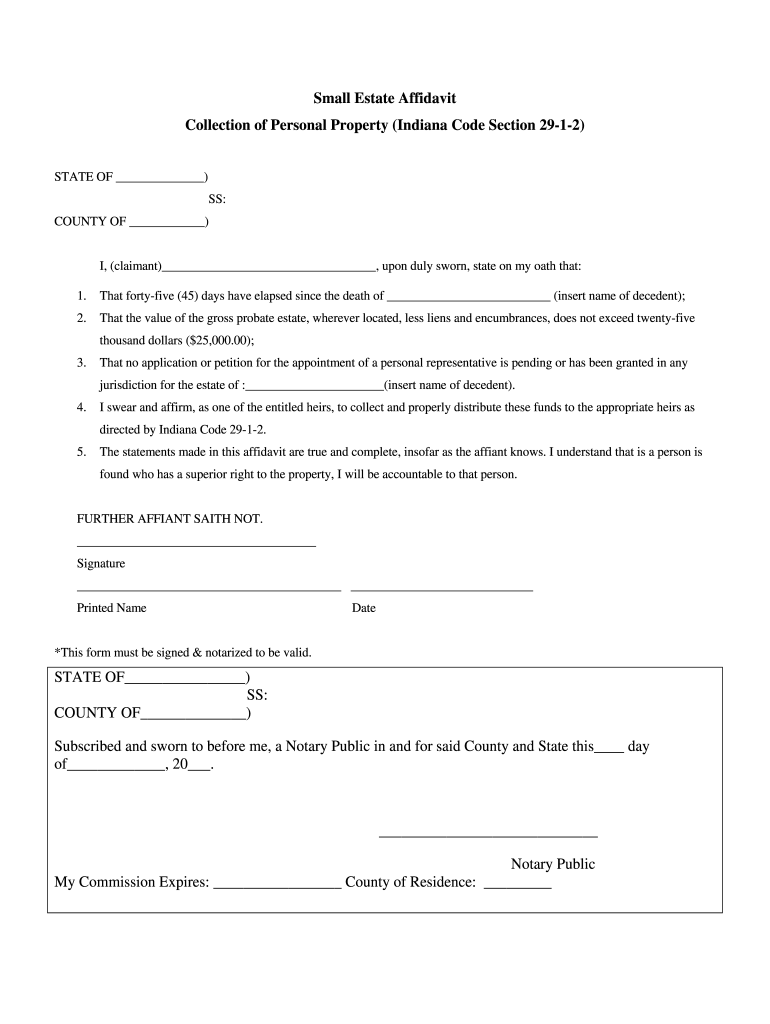

If theres no probate court proceeding and so no. How to File 5 steps Step 1 Wait Forty-five 45 Days Step 2 Prepare Affidavit Step 3 Notify Every Person Identified Step 4 Get It Notarized Step 5 Collect the Assets Step 1 Wait Forty-five 45 Days A period of forty-five 45 has to pass before you can use a small estate affidavit in the State of Indiana. Indiana Estate Planning Elder Law Hunter Estate Elder Law is an estate planning and elder law firm with a focus on asset protection wills trusts Medicaid planning Veterans benefits long-term care planning probate with trust administration and probate avoidance.

When the gross estate is less than the filing threshold no estate tax return is required. You would receive 950000. Income Tax Return for Estates and.

Where to File This Form Form IH-12 must be filed with the Indiana. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended. Income tax rates to increase in these 3 central Indiana counties The state is returning 545 million to Hoosiers after ending its fiscal year with a.

Inheritance tax was repealed for individuals dying after Dec. To check the status of your Indiana state tax refund go online to the INTIME portal or call 317-232-2240 the automated refund line. Until May 2013 Indiana had a state inheritance tax which was imposed on certain people who inherit money from an Indiana resident.

31 rows Filing Estate and Gift Tax Returns When to File Generally the estate tax return is due nine months after the date of death. No tax has to be paid. According to IC 6-3-4-1 and for taxable years beginning after Dec.

Its the job of the personal representative the executor named in the will to file the inheritance tax return if one is required. Filing a typical tax return is simple but completing one in the name of a decedents estate requires a little more work. Claim a gambling loss on my Indiana return.

Calling 1-800-TAX-FORM 800 829-3676. Were Indiana residents for less than a full-year or not at all or Are filing jointly and one was a full-year Indiana resident and the other was not a full-year Indiana resident and. You would pay 95000 10 in inheritance taxes.

A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Pay my tax bill in installments. Planning 2014s Taxes with Your 2013 Tax Return.

Nonresident estate or trust having any gross income from sources. Have more time to file my taxes and I think I will owe the Department. 55891 Beneficiarys Share of Indiana Adjusted Gross Income Deductions Modifications and Credits 0821.

Step 2 Prepare Affidavit. 31 2012 every resident estate or trust having gross income or. Estate or a trust is sometimes referred to as a pass-through entity.

The deceased was age 65 or older and had adjusted gross income more than 2000. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov. Youll need to provide your Social Security number as well as.

Most estates and trusts file Form 1041 at the federal level and file Form IT-41 at the Indiana level. Fill-in pdf Schedule Composite. Business or occupation 3.

InDIana InheRItance tax RetuRn foR a non-ReSIDent DeceDent note. If you have additional questions or concerns about estate planning and taxes contact an experienced Indianapolis estate planning attorney at Frank Kraft by calling 317 684-1100 to schedule an appointment. However an extension will not stop the accrual of interest for late payment of the tax.

Take the renters deduction. Contact an Indianapolis Estate Planning Attorney. INtax only remains available to file and pay the following tax obligations until July 8 2022.

The executor administrator or the surviving spouse must file an Indiana income tax return for the individual if. Dying With a Will in Indiana. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return.

Address of decedent at time of death 7. The gift tax return is due on April 15th following the year in which the gift is made. Date of death 4.

Find Indiana tax forms. Indiana Fiduciary Income Tax Return 0821 fill-in pdf IT-41ES. This all-important number will represent the estate in all tax situations.

50217 Fiduciary Payment Voucher 0821. You can apply online by fax or via mail with the IRS to receive an employer identification number EIN. If the IRS allows an extension to file a federal estate tax return Form 706 the corresponding due date for filing Form IH-12 is automatically extended for the same period of time.

Indiana Income Taxes and IN State Tax Forms Step 1. Up to 25 cash back That process outlined in Indiana Senate Bill 923 will take ten years completely eliminating the tax in 2022. Social Security number 6.

More than 999 of all estates do not owe federal estate tax. Form IT-40PNR for Part-Year and Full-Year Nonresidents Use Form IT-40PNR if you and your spouse if married filing jointly. Many of the necessary determinations are done at the federal level by the IRS.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Just one return is filed even if several inheritors owe inheritance tax. Therefore you must complete federal Form 1041 US.

Check your Indiana Tax Refund Status. Please read carefully the general instructions before preparing this return. Know when I will receive my tax refund.

The estate executor must file an estate tax return when the gross estate meets or exceeds the filing threshold based on the date of death. Decedents residence domicile at time of death 5. A Team Focused on Bookkeeping and Preparation for Trusts Estates and the Family Office.

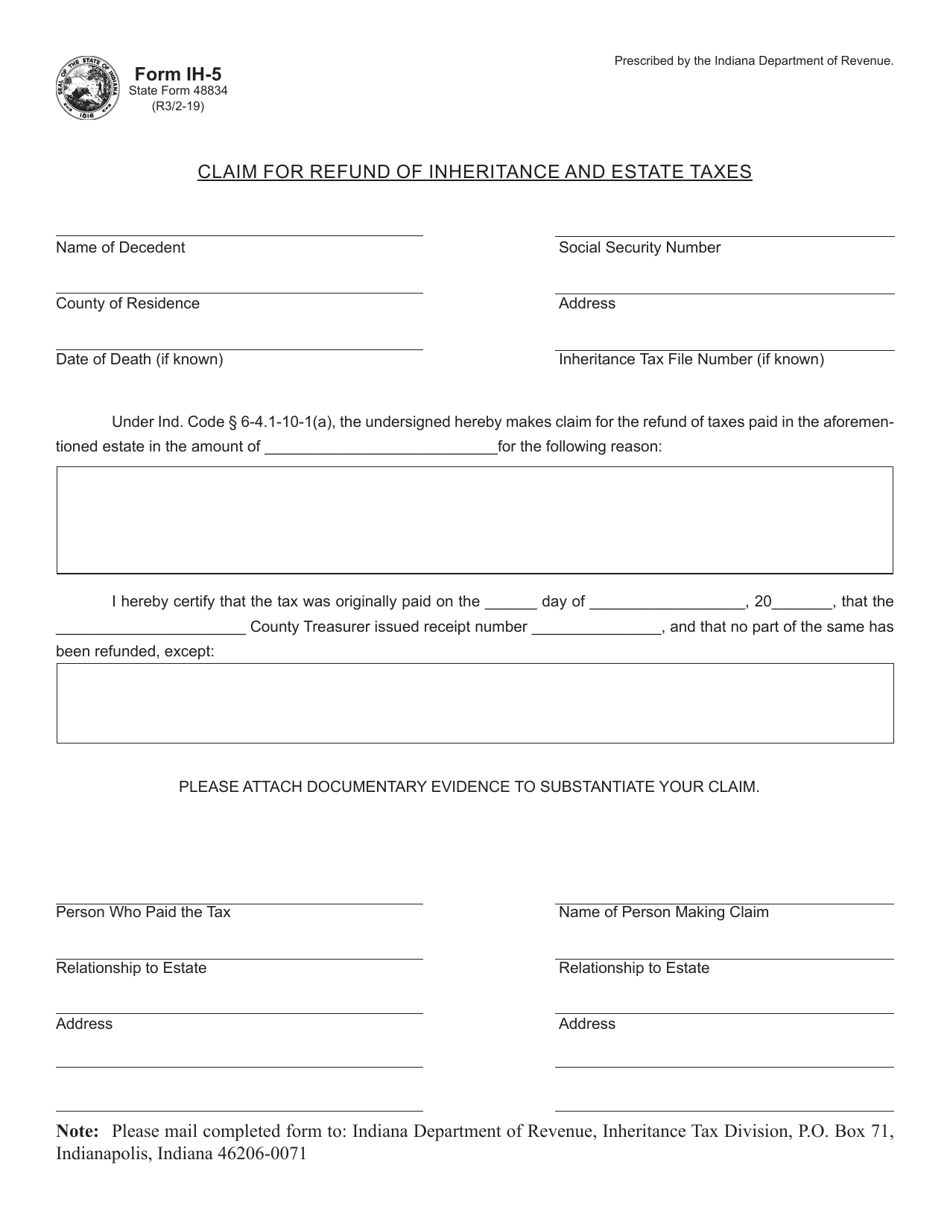

Inheritance Tax Refunds In general estates or beneficiaries of Indiana residents are required to file an inheritance tax return Form IH-6 if.

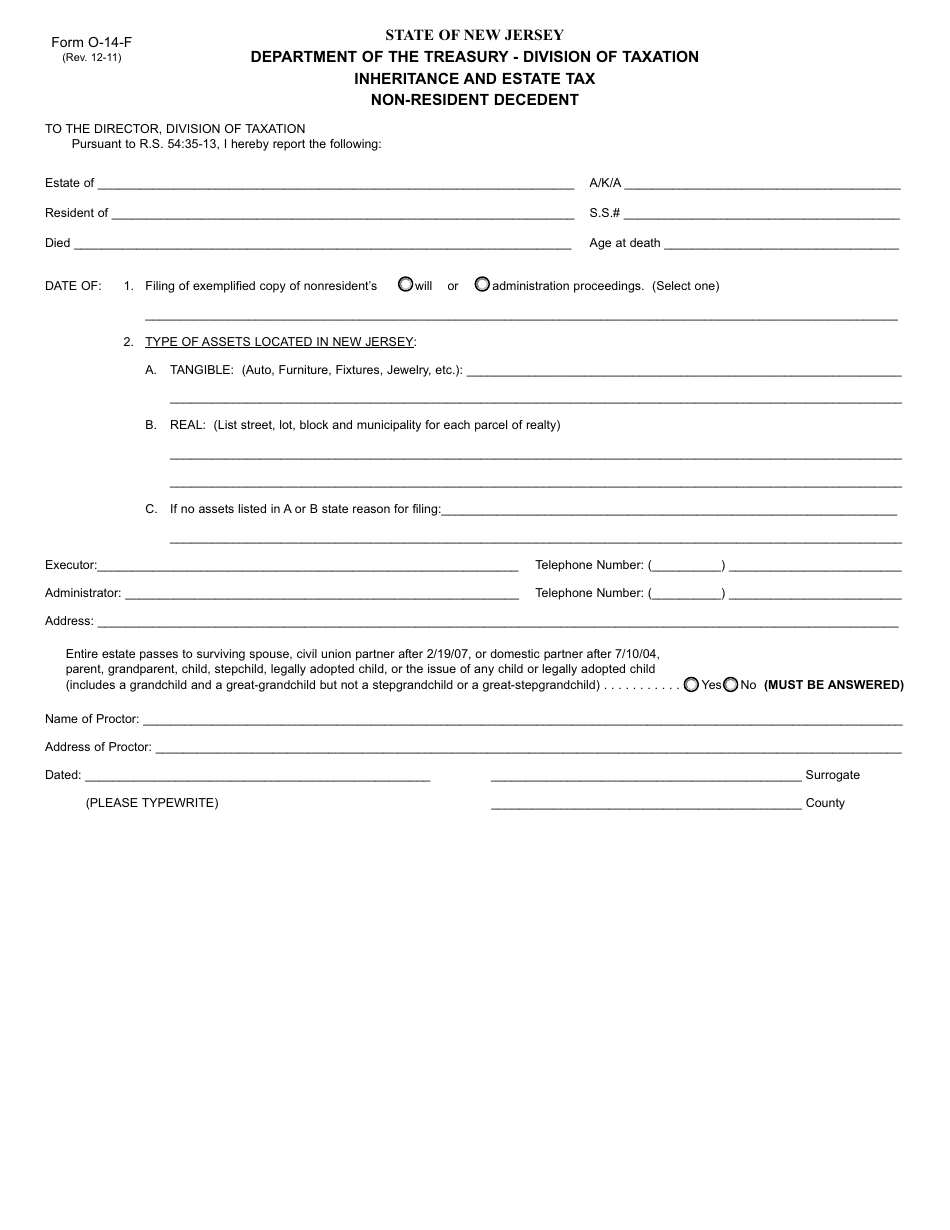

Form O 14 F Download Fillable Pdf Or Fill Online Inheritance And Estate Tax Non Resident Decedent New Jersey Templateroller

Indiana S 125 Automatic Tax Refunds To Begin Going Out In Next Few Weeks

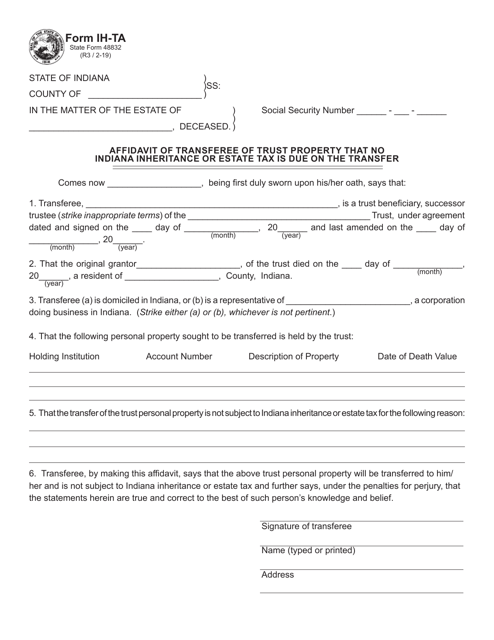

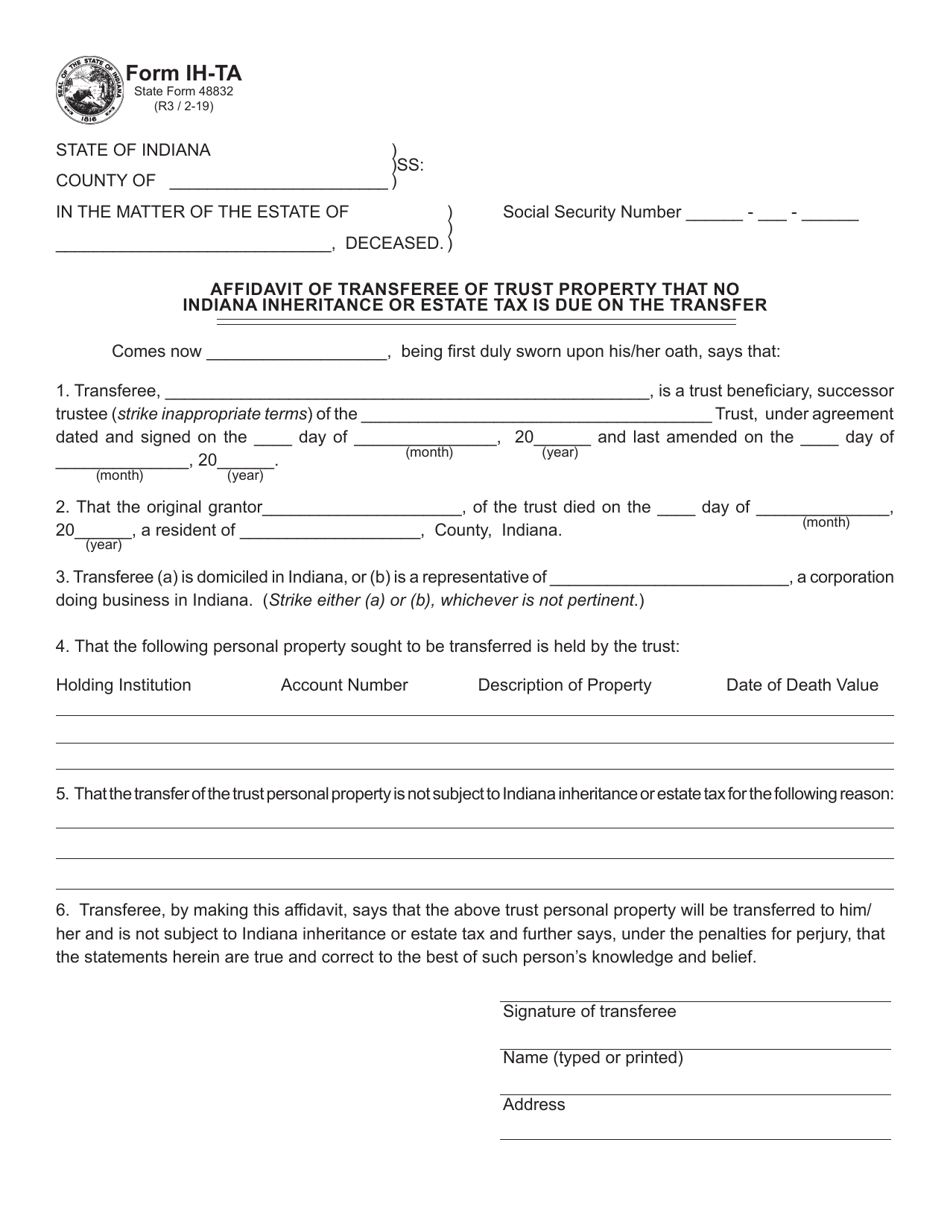

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana State Tax Information Support

Irs And Indiana Dor Extend Tax Filing Deadline To May 17 2021 Whitinger Company

Irs Provisions Followed Not Followed By Indiana Somerset Cpas And Advisors

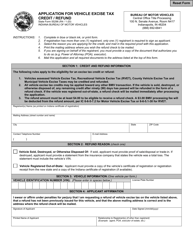

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

Indiana State Taxes For 2022 Tax Season Forbes Advisor

Form Ih Ta State Form 48832 Download Fillable Pdf Or Fill Online Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On The Transfer Indiana Templateroller

Indiana Estate Tax Everything You Need To Know Smartasset

2021 Estate Income Tax Calculator Rates

Small Estate Affidavit Indiana Fill And Sign Printable Template Online Us Legal Forms

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Indiana Estate Tax Everything You Need To Know Smartasset

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

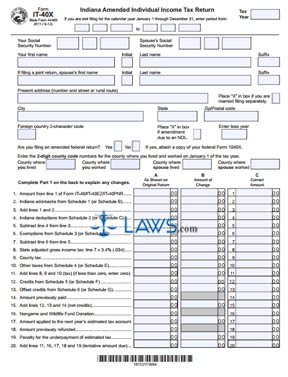

Free Form It 40x Indiana Amended Individual Income Tax Return Free Legal Forms Laws Com